Risk Management

Our approach

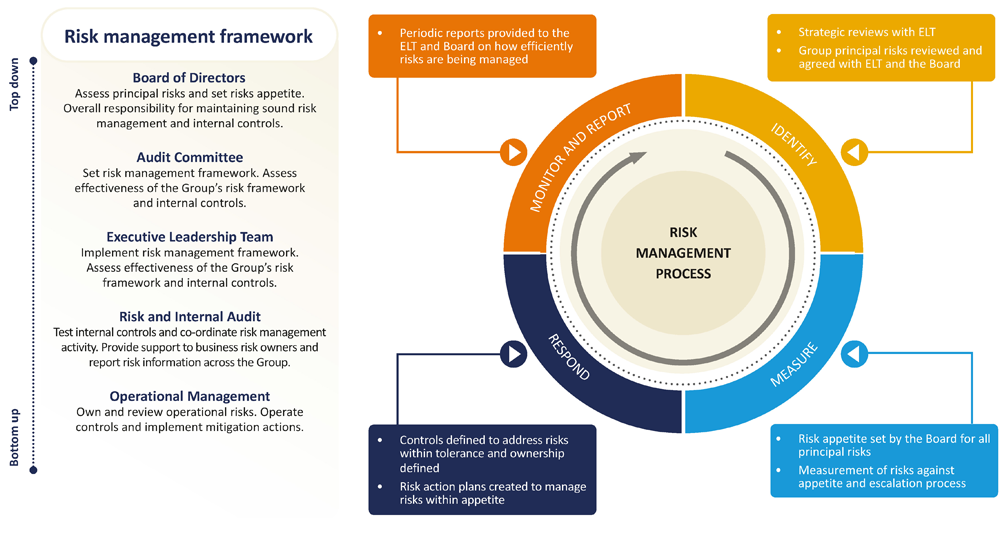

We have an established risk management framework to identify, evaluate, mitigate and monitor the risks we face as a business. Our risk management framework incorporates both a top-down and a bottom-up approach, to ensure that we have maximum input from the Board through to operational management, to identify both current and emerging risks that our business faces as we execute our strategy and grow the business. Our Board owns and oversees our risk management programme, with overall responsibility for ensuring that our risks are aligned with our goals and strategic objectives.

The Audit Committee assists the Board in monitoring the effectiveness of our risk management and internal control policies, procedures and systems. The Executive Leadership Team (ELT) performs a robust risk assessment on a periodic basis and the output from this is routinely reviewed by the Board and the Audit Committee.

Responsibility for risk management is embedded throughout our organisation and our first line of defence remains our colleagues, who have a responsibility to manage day-to-day risk in their areas guided by Group policies, procedures, and controls frameworks. The ELT and ultimately the Executive, ensure that these risks are managed, maintained, reviewed and mitigated according to these frameworks. The Group’s Internal Audit function continues to provide assurance over the effectiveness of mitigating controls. While copies of these reports are provided to the ELT to action any necessary control improvements, the Internal Audit function reports directly to the Audit Committee who monitor and challenge management to ensure control improvements are actioned.

Principal risks and uncertainties

The Board has carried out a robust assessment of the principal and emerging risks facing the Group. They include those that we consider most impact our business model, (see pages 12 and 13 of our 2023 annual report) and the delivery of our long-term strategic objectives (see pages 18 and 19 of our 2023 annual report) and that would threaten our business model, future performance, solvency or liquidity. These risks and uncertainties (pre-mitigation) are identified in the heatmap below, followed by a more detailed description including key mitigating activities in place to address them on pages 62 to 66 of our 2023 annual report. We have also considered the broadening potential impacts across a number of principal risks of inflationary pressures resulting from the ongoing Russia-Ukraine conflict. These initially impacted energy and commodity prices but have subsequently spread into wider inflationary pressures across the supply chain and are now being felt by our valued consumers. The ‘Changes since FY21/22’, highlight changes in the profile of our principal risks and/or describe our experience and activity over the last year.

Risk appetite

Our approach is to minimise exposure to reputational, financial and operational risk while accepting and recognising a risk/rewards trade-off in pursuit of our strategic and commercial objectives. Risk appetite statements are reviewed routinely by the ELT and approved by the Board to guide the actions that management takes in executing our strategy. As a food manufacturing company, with many well-known brands, the integrity of our business is crucial and cannot be put at risk. Consequently, we have zero tolerance for risks relating to food safety and the health and safety of our employees. In addition, we have set low risk appetites for a number of other risks such as cyber-security, legal, compliance, environmental and regulatory risks.

Nonetheless, we operate in a challenging and highly competitive marketplace and as a result we recognise that strategic, commercial and investment risks will be required to seize opportunities and deliver results at pace. We are therefore prepared to make certain managed financial and operational investments in pursuit of growth objectives. Our acceptance of risk is subject to ensuring that potential benefits and risks are fully understood and appropriate measures to mitigate those risks are firstly established.

Emerging risks

The ELT and the Board formally review emerging risks when considering the outputs of the risk management processes. Through both the top-down and bottom- up risk discussions held across the business, we seek to identify changes in both existing and new risks which may have a significant impact. This includes horizon scanning and utilising in-house knowledge and expertise supported by input from external sources, to identify emerging risks for consideration and review. These uncertainties may relate to future economic, regulatory, or environmental changes, for which examples include, the further rollout of legislation related to the UK Government’s programme to tackle obesity and Extended Producer Responsibility requirements for packaging.

While significant consideration has been given to assessing emerging risks, we have also concluded that these emerging risks are adequately captured across our existing broad set of principal risks and, as a result, no new principal risks are proposed this year.

Future initiatives

We continuously evolve and improve our approach to risk management, in light of the ever-increasing volatility and uncertainty in the external environment. In addition, risk plays a key role in the cross-functional team responsible for our approach to the requirements for Task Force on Climate-related Financial Disclosures (TCFD), under a dedicated steering group. We continue to embed the selection of the key risks used in our scenario analysis and support the integration of this activity into our ongoing risk processes, so that climate-related considerations become part of our longer term strategic thinking and decision-making in the business. See pages 38 to 48 of our 2023 annual report, for further details on our approach to TCFD.

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| Our business has been subject to a period of prolonged uncertainty owing to political and ongoing economic developments. While those risks related to Covid-19 have significantly dissipated, post the initial impact of the Russian/Ukrainian war on energy and commodity costs, this has subsequently spread into broader inflationary pressures that are creating a ‘cost of living crisis’ for our valued consumers (also see Risk 8). |

• We seek to hedge certain key commodities and energy supplies, where appropriate, to manage our exposure to price increases.

• In addition, we actively manage foreign exchange currency volatility through hedging activity and through an ongoing supplier risk management process.

• Our cost-saving and efficiency programmes seek to minimise the impact of inflationary pressures.

• The ELT closely monitors developments related to commodity costs, and only after careful consideration, and where absolutely necessary, are prices increased.

• We continually monitor our customer and supplier base for potential exposure to Russian (or any other applicable) trade sanctions. |

• The overarching risk trend was assessed as stable during the year, however, the blend of risk factors that contribute to the principal risk have varied. While we have experienced elevated input cost inflation, driven by macroeconomic forces, this has been balanced by a number of our brands, particularly within Grocery, performing proportionally well as our consumers switched to eating at home more often. This change in consumer preference has been supported by our ‘Best Restaurant in Town’ campaign, as detailed under our ‘Continue to Grow the UK Core’ strategic pillar (see page 18 of our 2023 annual report).

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| The continued focus on health and obesity may result in a decline in demand for cakes and desserts and/or our share of them, along with the risk of additional complexity and cost as a result of any reformulation efforts. There is an elevated level of media and Government scrutiny on health and obesity. The first phase of the Government legislation restricting promotions of High Fat, Salt or Sugar (HFSS) by ‘location’ became effective from 1 October 2022. It is expected that a second phase of restriction of HFSS products by ‘volume’ will come into force on 1 October 2023 followed by an ‘advertising’ restriction for such products from 1 October 2025. The UK Government has also introduced a new tax on non-recyclable plastic packaging as part of the reformed Packaging Producer Responsibility Regulations. The introduction of this escalating tax on plastic packaging and any further legislation may adversely impact the products that the Group manufactures. |

• We have a wide range of product offerings, which includes non-HFSS products, that extend our range of healthier choices, enhance the nutrition profile of our existing core ranges and help consumers to make healthier eating choices. Details can be found in our Enriching Life Plan section on pages 30 and 31 of our 2023 annual report.

• We have an ongoing evaluation and development of the brand portfolio and innovation pipeline with a focus on healthier options that help us align with changing consumer preferences (also see Risk 8).

• Our Environmental, Social and Governance (‘ESG’) Committee, chaired by our CEO, has a range of cross-functional steering groups that are responsible for the delivery of our ESG strategy, including our Packaging steering group. This ensures focused efforts, through KPI-driven targets, to optimise our packaging and reduce its environmental impact and mitigate the impact of the tax on non-recyclable packaging. This is achieved by using materials from certified sustainable sources wherever possible, increasing our use of recycled materials, and increasing the recyclability of our packaging. 96% of our packaging, by weight, is recyclable at year-end. |

• The risk profile remained stable year-on-year.

• The Group continues to actively adapt its strategy in order to support the phases of the UK Government’s programme to tackle obesity. This includes continuing to extend the range of non-HFSS products available to consumers.

• The UK Government’s primary legislation (November 2020) to introduce an escalating tax on plastic material came into effect on 1 April 2022 and the Group has continued its packaging optimisation programme to ensure both the minimisation of packaging and that packaging use is fully recyclable.

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| As a primarily UK-based company, our sales are concentrated, predominately with a number of major customers who operate in a highly competitive market. Maintaining strong relationships with our existing customers and building relationships with new customers and technology-enabled channels are critical for our brands to be readily available to our consumers. A failure to do this may impact our ability to obtain competitive pricing and trade terms and/or the availability and presentation of our brands. Actions taken by these retailers (for example, changes in pricing and promotion strategies), may negatively impact our financial performance and can also have an impact on the overall market for our products. |

• We have strong relationships with the major retailers built on the strength of our brands, our expertise in our categories and shopper insight.

• We have a programme of continuous innovation rooted in consumer insights and designed to build category growth.

• We develop commercial plans with customers that include investment and activation plans.

• We are growing our international business by applying our proven UK branded growth model strategy in target markets, which in time will reduce dependence on the UK market.

• We are investing to build our online channel presence and capabilities. |

• The risk profile remained stable year-on-year.

• We continued to work with all our customers, including category partnerships and range reviews, to match our product offering to consumer needs, particularly with more meals eaten at home.

• We recorded growth in branded sales as a result of our strong innovation pipeline, sustained brand investment and close customer partnerships.

• We continued to focus on presenting our brands well online, which helped drive growth ahead of the market.

• Our international business continued to grow thanks to progress in all the Group’s strategic markets: Ireland, Australia, the USA and Europe.

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| Delivery of our strategy depends on our ability to minimise operational disruption from issues with facilities, factory infrastructure as well as Procurement and Logistics functions. Supplier failure, market shortage or an adverse event in our supply chain impacts the sourcing of our products, and the cost of our products is significantly affected by commodity price movements. |

• We have business continuity and disaster recovery management processes in place. These are reviewed and refreshed on an ongoing basis.

• Appropriate insurance coverage is in place to mitigate the financial impact of material site issues.

• We have an appropriately resourced and skilled procurement function that possesses the requisite market and industry knowledge to pinpoint raw material market developments.

• Procurement category plans are in place to mitigate against single supplier risk.

• Cross-functional teams help to manage any sourcing challenges because of broader macroeconomic factors.

• We have robust quality management standards applied and rigorously monitored across our supply chain.

• We have an ongoing three-year programme (in conjunction with our insurers) to move our sites into a ‘Highly Protected Risk’ status.

• ELT reviews resourcing plans to ensure appropriate labour availability across factories, warehouse and transport. |

• The risk profile has remained stable during the year. • Our suppliers have continued to supply us with raw materials and bought-in finished goods, aided by accurate demand forecasting providing forward views of requirements.

• Our Procurement, Operational and Technical teams have also managed to source alternative suppliers for key ingredients where there were potential interruptions to supply.

• Our factories continued to maintain production levels through careful management of production capacity and through sourcing and retaining a reliable pool of labour.

• We improved our operational resilience through various initiatives, including Capex projects that replace existing plant and machinery and provide increased reliability and efficiency. See further detail in our ‘Supply Chain Investment’ strategic pillar on page 18 of our 2023 annual report.

• We continue to maintain high levels of customer service through our KPI monitoring of key suppliers, despite the disruptions caused in some of our key raw materials markets.

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| Our business is subject to many legal and regulatory requirements and must continuously monitor new and emerging legislation (domestic and international), in areas such as Health and Safety, listing rules, competition law, intellectual property, food safety, labelling regulations and environmental standards. We have also adopted the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (‘TCFD’). A more detailed overview of the impact of climate change on our business can be found in the TCFD section on pages 38 to 48 of our 2023 annual report. |

• We have dedicated Legal and Regulatory teams in place to monitor laws and regulations to ensure compliance, protect intellectual property and defend against litigation, where necessary.

• We work closely with our external advisors and the regulators, government bodies and trade associations regarding current and future legislation which would impact the Group.

• Whistleblowing processes are in place that are routinely tested to ensure that they are fit for purpose.

• We have leading food industry processes in place to manage health and safety and food safety issues (including an ongoing programme of internal and external audits).

• Regular mandatory compliance-related training is in place covering areas such as data protection, anti-bribery and corruption, Corporate Criminal Offence, anti-trust etc.

• As previously described, our ESG Committee oversees various initiatives, including compliance with TCFD recommendations. |

• The risk remained stable year-on-year.

• We have included disclosures on pages 38 to 48 of our 2023 annual report to comply with TCFD recommendations.

• Our risk management framework continues to be enhanced to accommodate and report on climate risks and appropriate disclosures in line with TCFD recommendations.

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| Climate change has the potential to dramatically change the world in which we live and operate. Tackling climate change, by taking measures to limit its impact to manageable levels, has become a key priority for governments and businesses. As the impacts of climate change become clearer, businesses are looking to understand how this will impact their operations. Through our work to disclose against the requirements of the Task Force for Climate-related Financial Disclosures (TCFD), we have identified risks and opportunities associated with operational disruption, ingredients sourcing, energy pricing, policy changes and changing consumer behaviour. |

• Our decarbonisation targets have been submitted to, and approved by, the Science-Based Targets initiative (SBTi) and are embedded within our Enriching Life Plan. We track progress against our targets in line with our commitments.

• An assessment of the physical risks associated with more extreme weather across the Company’s manufacturing sites has been carried out in partnership with our insurance partners, with investments made at our Lifton site to reduce the risk and impact of river flooding.

• An assessment of the risk of changes in the availability, price or quality of key ingredients, as a result of chronic changes in the climate in key sourcing regions has been carried out and mitigating actions to reduce the risk of supply issues on key commodities have been identified.

• An assessment of the risk associated with changes in the demand for our products in the event of changing weather patterns has been carried out and considered as part of our commercial planning. |

• The risk has remained stable year-on-year as we continue to make progress against the targets we have set for ourselves under our Enriching Life Plan, and required of us under TCFD.

• Please refer to pages 32 and 33 of our 2023 annual report for an update on our Enriching Life Plan, pages 38 to 48 for our TCFD statement and pages 178 to 183 for our Enriching Life Plan disclosure tables.

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| A successful cyber-attack, or other systems failure, could result in us not being able to manufacture or deliver products, plan our supply chain, pay and receive money, or maintain proper financial control. This could have a major customer, financial, reputational and regulatory impact on our business. |

• Our centrally governed IT function continually monitors known and emerging threats with incident response plans in place to manage/ eliminate these risks.

• This includes maintaining firewalls and threat detection and response systems with regular penetration testing performed.

• Disaster recovery plans across the Group are reviewed and tested.

• Information and IT policies are in place and are regularly reviewed. Compulsory IT training is regularly run including internal phishing awareness campaigns to validate that learning is embedded throughout the organisation.

• Our cyber-security strategy and actions are regularly monitored by the Audit Committee and the Board.

• We review our cyber- insurance coverage on a regular basis. |

• The risk profile has remained stable during the year as we continue to invest in our IT systems to remain protected and match the ever-increasing number and diversity of external security threats.

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| Consumer preferences, tastes and behaviours change over time. As part of this, the consumers’ desire for healthier choices and premiumisation are significant trends. Our ability to anticipate these trends, innovate and ensure the relevance of our brands are critical to our competitiveness in the marketplace and our performance. Furthermore, sales of many of the Company’s products can be adversely affected by seasonal weather conditions. We may fail to successfully evolve our portfolio to take advantage of growth categories and/or re-invent our core brands to meet consumer needs. |

• The Group offers a broad range of branded products across a range of categories and markets which offer a wide choice to the end consumer.

• We perform continual assessments of consumers and customer trends and have an insights programme in order to anticipate changes in consumer preferences and evolve our product offerings accordingly.

• We continue to invest heavily in new product development with well- established stage gate controls to ensure we continue to adjust to consumers’ requirements.

• We continue to review the impact of weather on sales during our monthly product performance reviews. |

• The risk remained stable year-on-year.

• The specific impact of inflationary pressure on our consumers (Risk 1) and the introduction of HFSS and other regulations (Risk 2) is discussed above.

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| The ongoing success of the Group is dependent upon attracting and retaining high-quality colleagues at all levels who can effectively implement the Group’s strategy. Due to economic uncertainty and change (Risk 1), there is a dual risk that the supply of labour may be, in certain areas, constrained and, in addition, the cost of labour could increase resulting in additional financial and operational pressure on the Group. |

• We continue to invest in colleague development and engagement initiatives on a focused basis. See ‘Our People’ on pages 34 and 35 of our 2023 annual report.

• We have processes in place to attract diverse talent into the business with the right capabilities and behaviours through our ‘in- house’ team.

• We have succession plans in place to retain and progress our internal talent pipeline.

• We have a well-established and successful graduate recruitment and development programme and invest heavily in apprenticeship training.

• We benchmark pay to make sure we remain competitive in the market and, where appropriate, make changes to our offering.

• Regular engagement surveys take place across the Company to obtain feedback from our colleagues. |

• The risk profile remained stable year-on-year.

• We continue to maintain a strong commercial focus on process and cost improvement to manage and mitigate the increased cost of labour.

• In addition, we maintain Group-wide communication tools as well as hold quarterly Town-Hall meetings to ensure colleagues are briefed on new strategic initiatives that will grow the Company.

Risk Trend

|

| Risk and potential impact |

How we manage it |

Changes since FY2021/22 |

| Our branded growth model, as set out on pages 12 and 13 of our 2023 annual report, is at the core of what we do. The strategy focuses on leveraging our strong brands through launching insight-driven new products, delivering sustained levels of marketing investment, and fostering strong retail and customer partnerships. In addition, we seek bolt-on acquisitions where we can leverage strong synergies with our existing categories to enable us to further accelerate our growth. Failure to timely deliver our strategy may result in taking longer than expected to deliver results, which may impact the speed at which we can deliver shareholder value. |

• Given the seasonal nature of many of our brands, media investment is targeted in periods of peak consumer demand and through the most cost-effective channels.

• Our new and existing product development programmes are based on deep consumer insight and continue to make our product ranges more relevant to the ever-changing lives of our consumers.

• Our strong strategic relationships with our key customers facilitate the creation and joint ownership of plans for mutual growth. |

• The risk profile remained stable during the year.

• Following The Spice Tailor acquisition, we have followed a rigorous integration programme to ensure the benefits of the acquisition are fully realised.

• Our branded growth strategy for delivering new product innovation based on consumer trends together with high-quality advertising behind our major brands continues to deliver.

• We continued to leverage our branded growth model in the Group’s strategic markets.

Risk Trend

|

Viability statement

The directors, in accordance with provision 31 of the UK Corporate Governance Code 2018, have assessed the viability of the Group, taking into account the current financial position, the Group’s strategic and financial plan, and the potential impact on profitability, liquidity and key financial ratios of the principal risks. These factors have also been carefully assessed in light of the current global political uncertainty driven by the conflict in Ukraine, inflationary pressures across the industry and the cost of living crisis.

The directors have determined that five years is the most appropriate period to assess viability over, this time frame is consistent with the way the Board views the development of the business over the medium-term and is appropriate for both business planning and measuring performance. The directors also considered the consistent business performance, nature of the Group’s activities and the degree to which the business changes and evolves, given the dynamic nature of the FMCG sector when determining the assessment period.

In order to report on the viability of the Group, the directors reviewed the overall funding capacity and headroom available to withstand severe, but plausible events and carried out a robust assessment of the principal and emerging risks facing the Group, including those that would threaten its business model, future performance, solvency or liquidity. This assessment also included reviewing mitigating actions in respect of each principal risk.

The starting point for the viability assessment is the Group’s strategic plan, which was updated and signed off by the Board in February 2023. Sensitivity analysis was applied to this base financial information and the projected cash flows were stress tested against a number of severe, but plausible scenarios, the viability assessment being an extension of the going concern assessment. As of 1 April 2023, £175m of committed borrowing facilities available to the Group, were undrawn, the covenants linked to the facilities are shown in note 20 of the financial statements. The Board reviewed the level of performance that would cause the Group to breach its debt covenants and considered all of the principal risks, focusing on those which have the potential to materially reduce Trading profit or adversely impact the Group’s liquidity. The risks considered to have the greatest potential impact have been modelled in the downside scenarios, further detail of which are shown in the table below.

Consideration has been given to the impact of climate change, which identified an increase in costs of external specialists, capital investment and regulatory requirement within the assessment period, best estimates for which are included in the Group’s strategic plan and a sensitivity was modelled as discussed above. An in-depth assessment of climate risk is progressing, providing greater insight into such risk, and while this work remains ongoing, it is not believed that the climate-related risks would have a significant impact on the business within the five year viability review period.

In assessing the Group’s viability, the Board also considered all the severe, but plausible scenarios simultaneously materialising and for a sustained period, in conjunction with mitigating actions such as reducing discretionary costs and capital investment. The likelihood of the Group having insufficient resources to meet its financial obligations and breach its covenants is unlikely under this scenario.

In addition, a reverse stress test was conducted to identify the magnitude of Trading profit decline required, before the Group breaches its debt covenant, which indicates that a Trading profit decline of broadly half in each year of the five year review period, is required to breach covenants, which is considered extreme and not plausible.

Based on this assessment, the Board confirms that it has a reasonable expectation that the Group will be able to continue in operation and meet its liabilities as they fall due over the three-year period to 1 April 2028.

|

Risk scenarios modelled

|

Action taken

|

Link to principal risks

|

|

Materials, packaging, utilities and supply chain inflation in the marketplace*

|

We have modelled further inflation in the marketplace, increasing input costs. We have assumed that this is not all recovered with an adverse impact on volume and margin.

|

1 3 4

|

|

A cyber-attack shuts down the operating systems temporarily stopping production

|

We have modelled production stopping at all manufacturing sites for two weeks in the viability review period, with the associated loss of sales due to the halt in production and taking into account the levels of stock held.

|

7

|

|

Climate change: impact on revenue*

|

We have modelled the expected reduction in revenue anticipated if

Representative Concentration Pathway (‘RCP’) 8.5 were followed.

|

6 7

|

|

Covid-19: Managing human resources in response to unplanned events*

|

We have modelled disruption to our supply chain due to the outbreak of an infectious disease which drives labour shortages or outbreaks leading to half of our manufacturing sites being closed for a one week period on two occasions during the review window, including the associated loss of sales, and taking into account the levels of stock held.

|

4 7 9

|

|

Retailer strategy results in margin dilution*

|

We have modelled a reduction in gross margin for our UK business over the viability review period.

|

1 3 10 |

* Risk impact included in the Going Concern 12 month review period

Full information on our TCFD climate-related disclosures can be found on pages 38 to 48 of our 2022/23 Annual Report